Energy Investment Decision-Support Platform

Energy Investment Decision-Support Platform

Energy infrastructure investments require balancing technical feasibility with economic viability—a challenge that traditional approaches handle in isolation, leading to suboptimal decisions. This platform integrates DC Optimal Power Flow (DCOPF) with financial modeling to enable data-driven comparison of generation and storage scenarios. Developed as an MSE specialization project, it combines power systems engineering with investment analysis, validated through 10 scenarios on a 9-bus test network.

Technical Approach

The platform uses three core methods to evaluate energy infrastructure scenarios:

DC Optimal Power Flow models grid operations through linearized power equations, optimizing hourly dispatch while respecting generator limits, transmission capacity, and storage constraints. The formulation uses linear programming with 4,000+ variables per scenario, solved via CBC:

Power flow: Pij = Bij(θi - θj)

Storage Integration models battery State of Charge (SoC) evolution with charge/discharge efficiency losses (99%) and cyclical boundary conditions, enabling temporal arbitrage of renewable generation.

Investment Analysis calculates Net Present Value across 10/20/30-year horizons using discounted cash flows:

NPV = Z0 + Σ(Zt/(1+i)t)

Annuity conversions enable direct cost comparison between scenarios. Sensitivity analysis with ±20% load variations tests robustness.

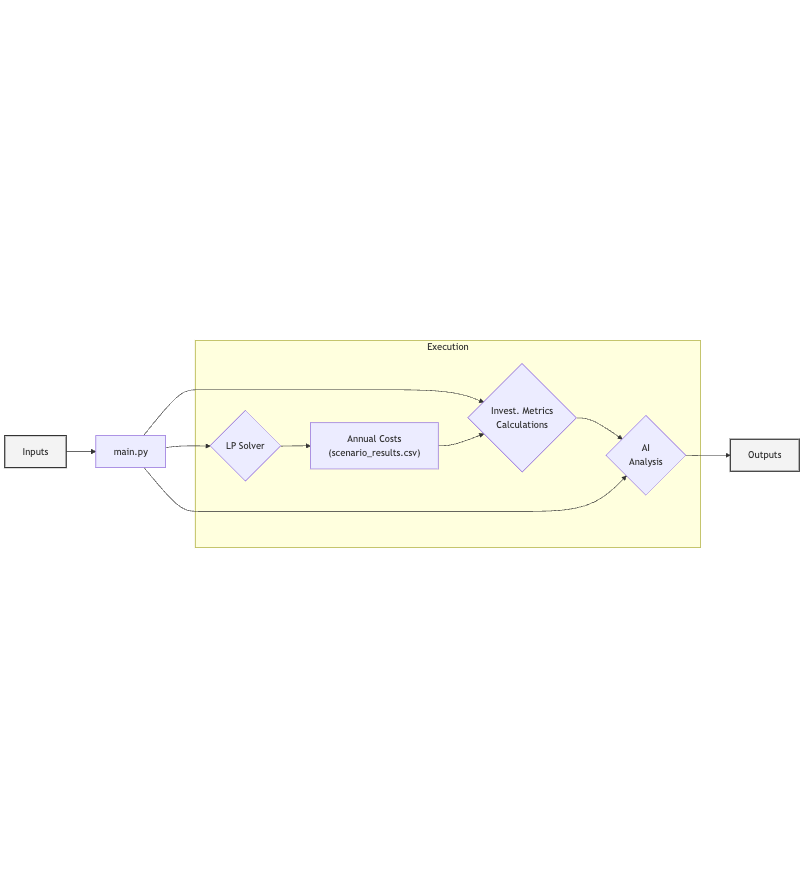

System architecture: Data ingestion → DCOPF optimization → Financial analysis → Comparative reporting

System architecture: Data ingestion → DCOPF optimization → Financial analysis → Comparative reporting

Implementation: Python with PuLP solver, MATPOWER format compatibility, 17× computational speedup via representative week selection (STL decomposition for load validation).

Case Study & Results

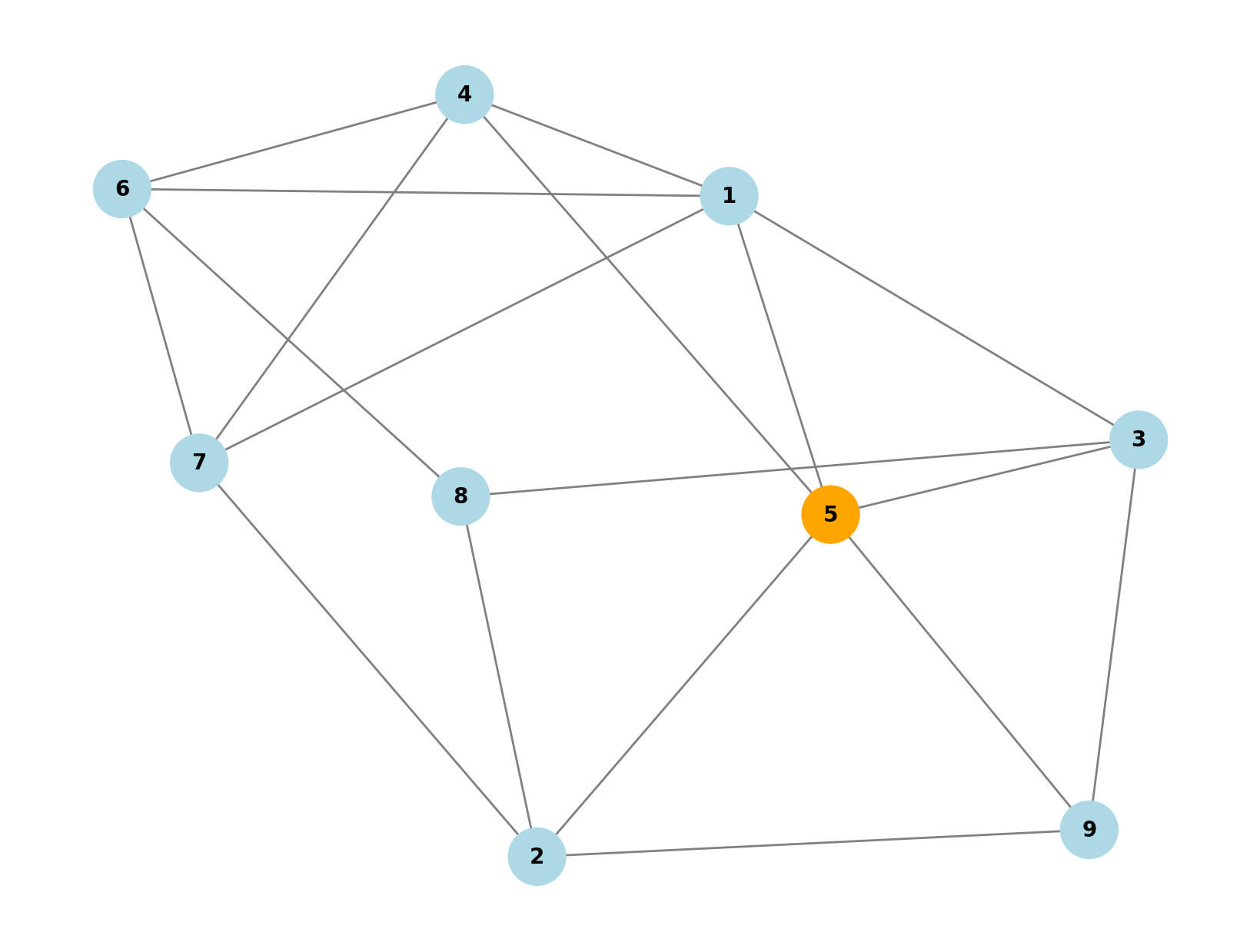

The validation study used a 9-bus network with 10 scenarios comparing Nuclear, Gas, Wind, Solar, and Battery storage combinations. Renewable generation data from Sion, Switzerland (46.231°N, 7.359°E) via renewables.ninja.

9-bus test network (230 kV, 60 MW line limits, 100 MW max demand at Bus 5)

9-bus test network (230 kV, 60 MW line limits, 100 MW max demand at Bus 5)

Key Findings

Best performing scenarios: Balanced renewable + storage portfolios achieved ~1.35M CHF/year annualized costs with NPV of -9.9M CHF (10-year horizon). Solar+Wind+Nuclear+Battery configurations optimized zero-cost renewable generation with right-sized storage.

Worst performer: Gas-dependent scenario with oversized battery storage (1.84M CHF/year, -13.0M CHF NPV) demonstrated the economic penalty of fuel costs and over-investment.

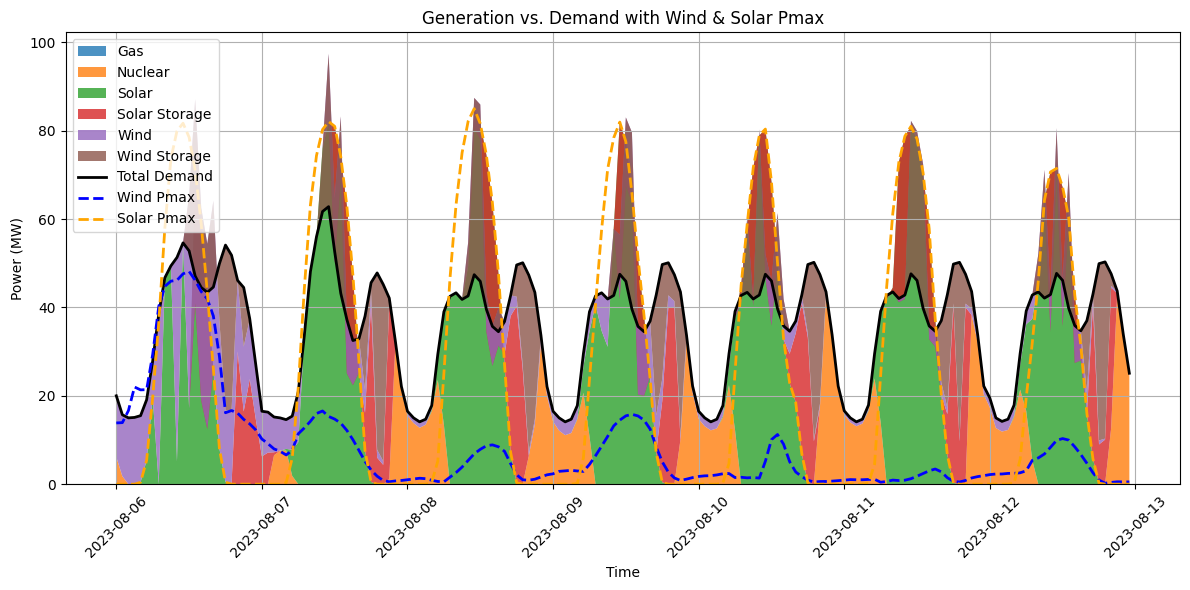

Summer week dispatch showing solar peak midday, battery charging during excess generation, discharging during evening demand

Summer week dispatch showing solar peak midday, battery charging during excess generation, discharging during evening demand

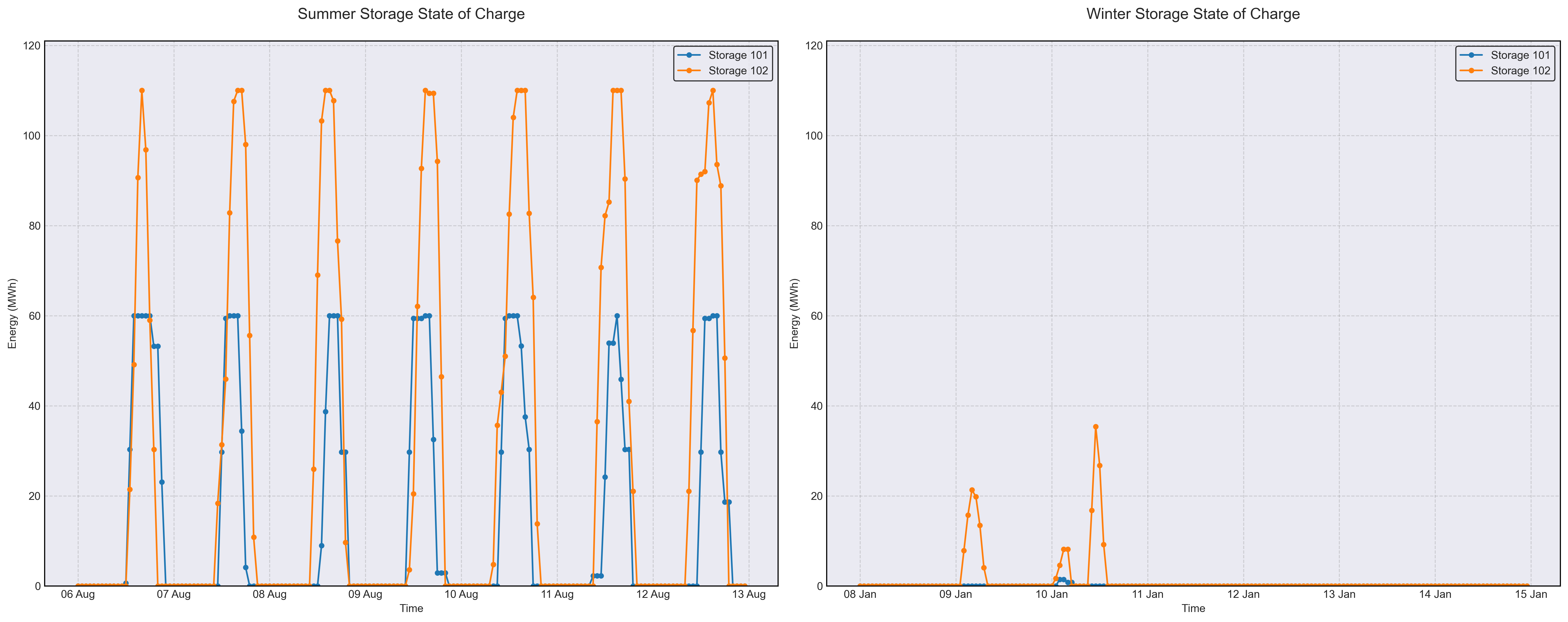

Battery State of Charge in renewable-heavy scenario (Scenario 5): Pronounced daily cycling with solar generation

Battery State of Charge in renewable-heavy scenario (Scenario 5): Pronounced daily cycling with solar generation

Economic Comparison

| Scenario | Configuration | Annuity (CHF/yr) | NPV 10y (M CHF) | |----------|---------------|------------------|-----------------| | 7 (Best) | Solar+Wind+Nuclear+Battery2 | 1.35M | -9.9M | | 3 | Wind+Solar+Nuclear+Battery | 1.36M | -9.8M | | 6 | Wind+Nuclear+Solar | 1.36M | -9.8M | | 4 (Worst) | Nuclear+Wind+Gas+2×Batteries | 1.84M | -13.0M |

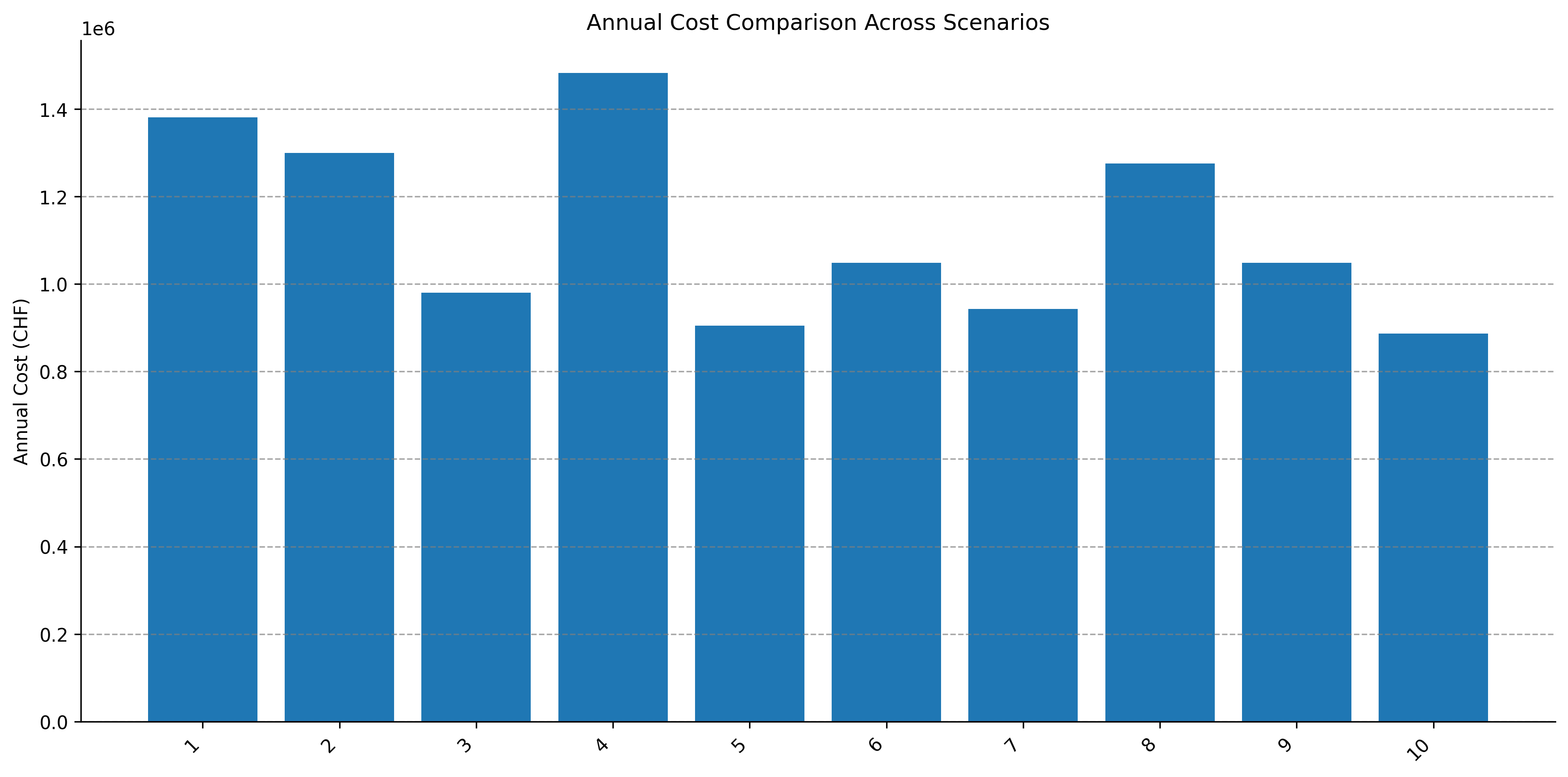

Annuity comparison across all 10 scenarios—balanced technology mixes outperform single-technology approaches

Annuity comparison across all 10 scenarios—balanced technology mixes outperform single-technology approaches

Outcomes

The platform delivers:

- Integrated assessment: Simultaneous evaluation of technical feasibility (grid constraints, storage dynamics) and economic viability (NPV, annuity, sensitivity)

- Quantified trade-offs: Zero-cost renewables with optimally sized storage consistently outperform conventional gas-dependent configurations by 25-35%

- Decision support: Scenario comparison enables identification of cost drivers and investment risks across 10/20/30-year horizons

- Scalability: Modular architecture supports larger networks and diverse use cases (utility planning, microgrid design, renewable integration studies)

Technical validation: 17× computational efficiency through representative weeks, 4,000+ optimization variables per scenario, automated reporting via AI-enhanced analysis.

The project demonstrates that energy infrastructure decisions benefit from simultaneous technical and economic modeling—enabling stakeholders to evaluate scenarios based on both engineering constraints and financial reality rather than optimizing each dimension independently.